In the context of the global push for carbon neutrality, the commercial refrigerator industry has become increasingly important. According to data from the International Energy Agency (IEA), refrigeration appliances account for 18% of global household appliance energy consumption. As global ownership continues to grow, it is expected to exceed 1.5 billion units by 2030, with corresponding increases in energy demand. If not effectively controlled, this will have a huge impact on global carbon emissions. Therefore, energy efficiency improvements in the frozen economy industry, such as refrigerators and ice cream cabinets, are crucial for achieving carbon neutrality goals.

Through technological innovations such as variable frequency compressors and natural working fluids (e.g., CO₂ refrigeration), energy consumption of food-grade freezers can be effectively reduced, carbon emissions can be minimized, and the global carbon neutrality process can be supported. From pre-cooling of agricultural products at production sites to cold-chain transportation and terminal supermarket refrigerator storage, the efficient operation of the entire fresh food supply chain relies on refrigerators.

In the agricultural product circulation link, improving preservation efficiency and reducing losses promote agricultural industrialization upgrades. For example, perishable fruits and vegetables can extend their shelf life in suitable cold-chain environments, reducing waste from spoilage. This not only helps ensure the stability of agricultural product supply but also aids in reducing carbon emissions in agricultural production (by minimizing carbon emissions from replanting due to waste).

Meanwhile, the development of the high-end refrigeration cabinet industry drives collaborative growth in upstream and downstream industries, such as compressor manufacturing and refrigeration material production. These industries also need technological innovation and industrial upgrading to reduce carbon emissions, forming an interconnected and mutually influencing industrial ecosystem.

With consumption upgrading, consumers’ demand for high-quality food ingredients is increasing, driving sustained growth in refrigerator demand in both household and commercial sectors. On one hand, households require large-capacity, multi-temperature-zone, energy-efficient refrigerators to store various food items. On the other hand, commercial sectors such as supermarkets, convenience stores, and restaurants have huge demand for refrigerators, with higher requirements for refrigeration performance and intelligence.

Changes in consumer market demand are also guiding consumption trends toward greater greenness, environmental protection, and efficiency. When higher energy efficiency grade refrigerator products are launched, consumers gradually enhance their awareness of environmental protection and energy conservation during the selection process, thereby driving the entire consumer market toward aligning with carbon neutrality concepts.

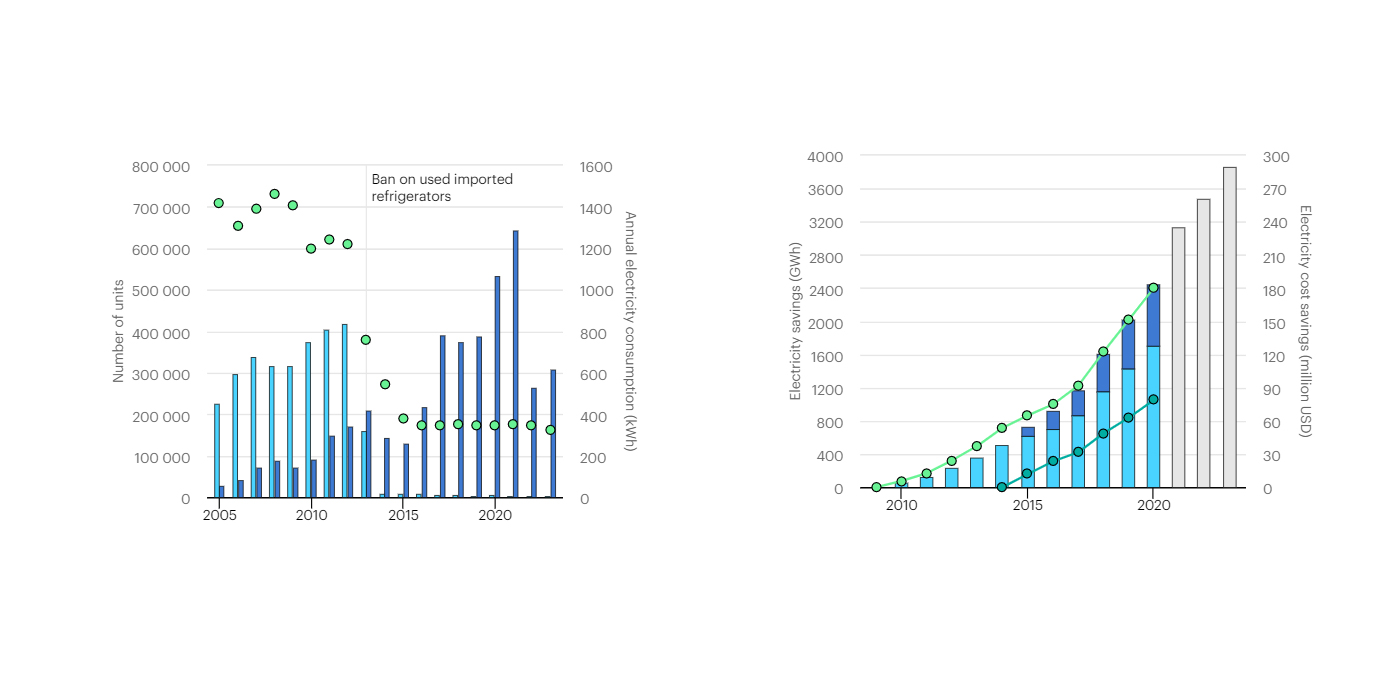

The environmental refrigerator industry plays a vital role in the global economy and trade. Under the carbon neutrality background, countries’ energy efficiency standards and environmental policies are continuously upgraded, which not only brings pressure for technological innovation and industrial upgrading to the refrigerator industry but also creates new market opportunities. For example, the EU’s energy efficiency label reform and China’s new national standards have prompted enterprises to increase investment in energy-saving technology research and development, pushing products toward higher energy efficiency levels.

NW notes that the reconstruction of the global refrigeration industry’s display cabinet industrial chain, with patent layouts in high-end refrigeration technologies, enterprises are breaking through through technological innovation and supply chain localization. This interaction in global economic games influences the development direction of cold drink industrial chains in various countries and the global trade pattern, being of great significance for achieving economically sustainable development under global carbon neutrality goals.

I. Energy Efficiency Standard Upgrades: The Green Transformation Engine of the Freezer Industry

As indispensable high-energy-consuming equipment in global household and commercial scenarios, the energy efficiency level of freezers directly affects global carbon emissions. The impact of the EU’s energy efficiency label reform is particularly significant. In 2021, the EU adjusted the energy efficiency grades of freezers from A+++ to A-G, requiring enterprises to redefine product energy efficiency baselines. For example, the new A-grade standard reduces energy consumption by 30% compared to the old standard, leading to 90% of existing products on the market being downgraded to B or C grades. This reform has forced enterprises to accelerate technological iteration. For instance, Haier freezers have upgraded their energy efficiency to A++ grade through variable frequency compressors and CO₂ refrigeration technology, successfully entering the European market.

In 2025, China will upgrade its commercial freezer energy efficiency standards to international leading levels, requiring a 20% improvement in the coefficient of performance (COP) for self-contained condensing unit freezers. This policy has driven Chinese freezer enterprises to accelerate technological innovation. For example, Dongbei Group’s independently developed 6th-generation variable frequency compressor has a COP value of 2.18, a 15% improvement over the industry average, and has obtained patent authorizations in Europe and the United States.

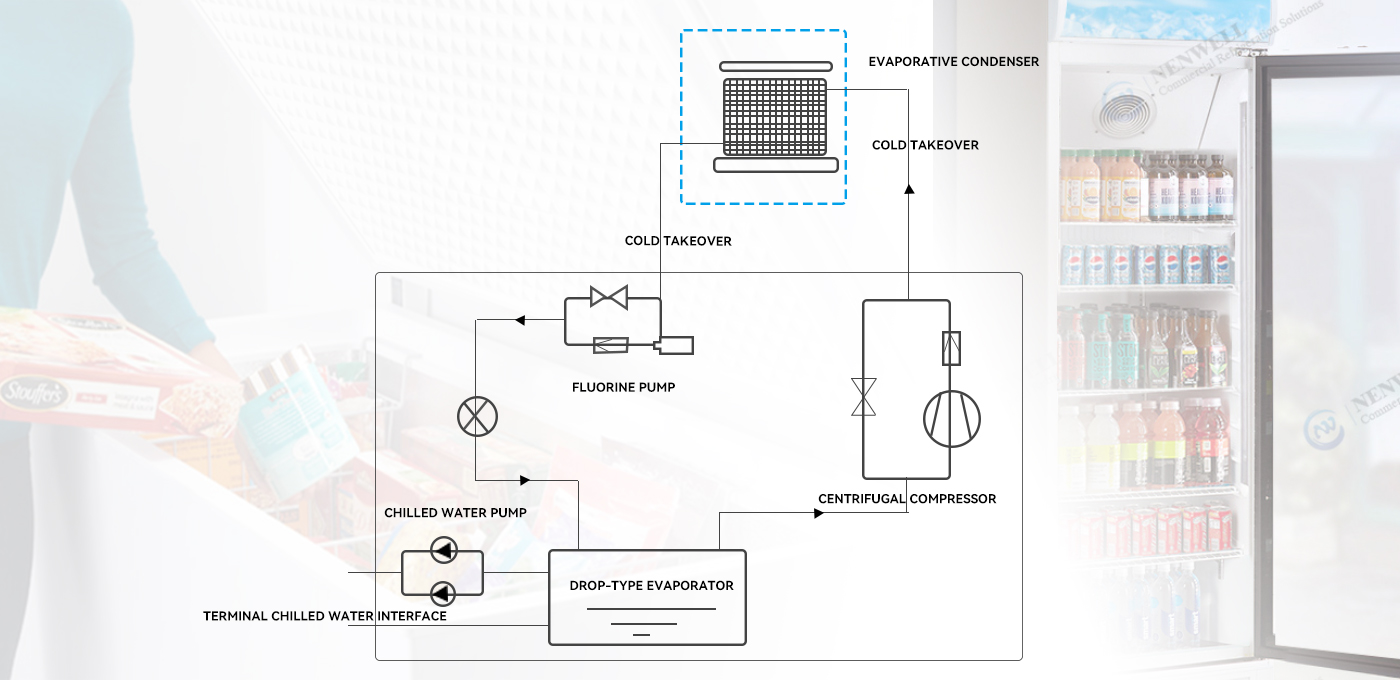

II. Technological Iteration: Dual Breakthroughs in Variable Frequency and Natural Working Fluids

Variable frequency compressor technology is key to energy efficiency improvements in refrigerators and other appliances. Traditional fixed-frequency compressors have large energy consumption fluctuations, while variable frequency technology reduces freezer energy consumption by 30%-40% through adjusting motor speed. For example, NENWELL freezers use full DC variable frequency technology, reducing daily power consumption to 0.38 kWh, a 50% energy saving compared to traditional products. Through the “separated heat-insulated exhaust silencer cavity” technology, compressor noise is reduced to 38 decibels while improving energy efficiency.

III. Technological Barriers and Global Industrial Chain Reconstruction

Developed countries control high-end refrigeration technologies through patent layouts. Danfoss of Denmark holds over 2,000 patents in the compressor field, covering key technologies such as variable frequency control and CO₂ system design. Germany’s Bosch monopolizes the production processes of high-efficiency thermal insulation materials. These technological barriers make it difficult for developing country enterprises to enter high-end markets. For example, cold storage imports in African countries rely on European brands, priced twice as high as Chinese counterparts.

NENWELL, as a rising star in the refrigeration industry, builds competitiveness through differentiated technological approaches:

- Product Matrix: Covers a full range of vertical freezers (50-500L) and horizontal freezers (100-1000L). The commercial vertical freezers adopt a “double-circulation three-temperature-zone” design, enabling simultaneous operation of -18°C freezing, 0-5°C refrigeration, and 10-15°C fresh-keeping, meeting the zoned storage needs of supermarkets, fresh produce, and catering ingredients.

- Core Technology: Equipped with the self-developed “X-Tech variable frequency engine,” using vector control algorithms and rare earth permanent magnet materials, with a coefficient of performance (COP) reaching 3.0, a 25% improvement over the industry average. It is compatible with CO₂ transcritical refrigeration systems, with a global warming potential (GWP) of only 1.

- Market Performance: In 2024, NENWELL freezers held a 12% market share in Southeast Asia, with a 38% year-on-year growth in the European market. Among them, the 500L horizontal freezers with intelligent temperature control systems accounted for over 7% of the German food retail channel market share, becoming the first Chinese emerging enterprise to enter the top 10 European freezer brands in sales.

Dongbei Group invested 30 million yuan in R&D of ultra-low temperature compressors, successfully breaking through -86°C refrigeration technology to replace imported products. Haier freezers have established production bases in Egypt, Turkey, and other places through the “trinity” globalization strategy, achieving localized R&D and manufacturing to avoid trade barriers. In 2024, China’s freezer export volume reached 24.112 million units, a year-on-year increase of 24.3%, accounting for 55% of the global market share.

IV. Global Economic Games: The Strategic Value of Green Freezers

Trade policies and technical standards have become new battlefields for great power competition. The U.S. Inflation Reduction Act provides a 30% tax credit for domestic freezer manufacturing, while the EU’s Carbon Border Adjustment Mechanism (CBAM) requires imported freezers to declare their full lifecycle carbon footprints. Some enterprises respond through green supply chains, such as using green steel (low-carbon steel) and recycled plastics, reducing product carbon footprints by 40% and passing SBTi scientific carbon target validation.

Technology export and standard setting are long-term strategies for global enterprises. Dongbei Group has applied for patents such as “resonating cavity air intake silencers” in Europe and the United States and participated in international standard development. The CO₂ refrigeration technology standard led by Haier freezers has been included in the white paper of the International Institute of Refrigeration (IIR). These measures not only enhance enterprises’ voice but also provide solutions for the green transformation of the global freezer industry.

V. Future Trends: Technology Integration and Circular Economy

The deep integration of intelligent technology and quick-freezing cabinets will reshape industry patterns. IoT sensors can real-time monitor freezer energy consumption, and AI algorithms can optimize refrigeration cycles, reducing energy consumption by an additional 10%. For example, Midea freezers’ “intelligent temperature control” function automatically adjusts refrigeration power by learning user habits.

The technological iteration and industrial chain reconstruction of the freezer industry essentially represent the microcosm of the global economy’s transition to green and low-carbon development. In the future, competition in the freezer industry will focus on technological innovation, standard setting, and circular economy, which not only concern enterprise survival but also the realization of global carbon neutrality goals. Freezers, seemingly ordinary home appliances, are becoming new battlefields in global economic games.

Post time: Apr-23-2025 Views: